[bisq-network/proposals] Reduce maker trading fee and lightlty increase BSQ fees (#181)

MwithM

notifications at github.com

Wed Mar 4 12:34:59 UTC 2020

> _This is a Bisq Network proposal. Please familiarize yourself with the [submission and review process](https://docs.bisq.network/proposals.html)._

<!-- Please do not remove the text above. -->

## Proposal

This proposal aims to change Bisq DAO parameters for Maker and Taker fee for BTC and BSQ as displayed in the next tables:

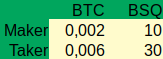

**Current fees**

**Proposed fees**

### Motivation to reduce maker trading fees

Market makers at Bisq face extra costs and risks compared to takers and other exchanges. They have to:

- Run a node to keep offers online.

- Leave their bitcoins in a hot wallet without 2FA.

- For Instant trades, they await to be "called" to settle an offer, and take care of disabling offers when AFK.

- Face extra volatility due to low volumes.

- Rely on price feeds from bitcoin average and poloniex.

- Pay a fee to remove an offer.

Some [exchanges](https://blog.deribit.com/insights/maker-taker-fees-on-crypto-exchanges-a-market-structure-analysis/) already have zero or *negative* trading fees for market makers. This is impossible for Bisq, as trading fees is also a measure against network spam, but if these markets can even work with negative fees, we shouldn't fear to reduce by half market maker fees while taker fees are increased proportionally. Bisq is addressing their users to post offers to increase liquidity, and this proposal makes it easier for them.

### Motivation to increase BSQ fees

BSQ fees are increased 10% to keep track of this [proposal](https://github.com/bisq-network/proposals/issues/173) which was rejected because it supposed a drastic increase of BSQ fees in fiat terms. I think that the general idea of keeping BSQ fees at 50% discount of BTC was [not rejected](https://github.com/bisq-network/proposals/issues/173#issuecomment-586983252) so Bisq should adjust BSQ fees to reach that goal.

In this proposal, at current prices (0.7 USD/BSQ), paying with BSQ suppose a discount of 53%, while now it's about a 60% discount. It's a steady fee increase that should not disturb traders very much.

This part of the proposal is subject to BSQ and BTC volatility. If there's general acceptance, DAO proposal with parameter changes will be submitted close to the end of proposal phase.

--

You are receiving this because you are subscribed to this thread.

Reply to this email directly or view it on GitHub:

https://github.com/bisq-network/proposals/issues/181

-------------- next part --------------

An HTML attachment was scrubbed...

URL: <http://lists.bisq.network/pipermail/bisq-github/attachments/20200304/6a71f479/attachment-0001.html>

More information about the bisq-github

mailing list